Writing a valid will and testament

- Legal Dynamix

- Nov 8, 2022

- 11 min read

Updated: Aug 20, 2024

Will you or will you not?

Dying is a nasty habit. Dying without a will is even nastier for the loved ones you leave behind. In this article, we discuss (a) the importance of having a will, (b) the legal requirements for a valid will, and (c) other factors to consider.

What is a will or a testament?

A will is a written document (handwritten or typed up) by a person that states what you want to happen to your estate once you have passed away. When you die, your estate becomes frozen until the appointed executor has (a) paid any debts you owe to creditors, and (b) then distributes the residue of your estate in accordance with your will. A will or a testamentary document speaks for you after you have gone, and under South African law, any person over the age of 16 has complete testamentary freedom, ie a person has choices to make as to what they want to happen to their estate upon their death (subject to certain limitations in accordance with the law).

A male person signing a will is known as a testator while a female is known as a testatrix.

Dying without a will

When a person dies without having entered into a will, or the written document does not comply with the legal requirements for a valid will, then the person is deemed to have died intestate. In terms of the Intestate Succession Act of 1987, an intestate estate will be inherited by certain designated heirs according to a hierarchy. If the deceased was survived by only a spouse (regardless of whether it was under a civil marriage, civil union marriage, an African customary marriage (including polygamous ones) or religious marriages) with no children then the spouse would be the sole heir. If there were children born of the marriage then the spouse would be entitled to the greater of a child's share or R250 000, and the children would inherit in equal share the residue of the estate.

For example, if the value of the estate was R1m, after paying all amounts to creditors, where there is a surviving spouse and one child, the estate would be divided by two and the spouse would be entitled to the greater of R250 000 or an amount equal to the child’s share, and in this instance, that amount would be R500 000. If there were four children then the surviving spouse and four children would count as five people inheriting the estate but the surviving spouse would be entitled to the minimum of R250 000 while the four children would share the residue of R750 000 equally (being R187 500).

If there was no spouse(s) or children then parents, siblings and other relatives would share the estate according to the hierarchy. In the case of multiple wives in terms of an African customary marriage, each wife would be entitled to an equal share of whatever amount is due to them.

If there are no relatives available to inherit then the deceased estate would be forfeited to the State.

The disadvantage of dying intestate is that it is the law that dictates who inherits rather than the individual. For this reason, it is always advisable to enter into a valid will that expresses your wishes and choices on how your estate will be handled by the executor and who your heirs will be. Imagine if your creepy uncle or annoying cousin ended up getting everything in your estate because there was no one else left to inherit!

Previously, persons who were cohabiting (also known as common law marriage) had no rights to inherit under intestate law but this changed as a result of the Constitutional Court judgement in Bwanya vs Master of the High Court and others handed down in December 2021. In that case, the court ruled that persons in a cohabitation relationship (or a permanent life partnership) were entitled to inherit under the Intestate Succession Act of 1987 and to claim maintenance under the Maintenance of Surviving Spouses Act of 1990. However, the court order was suspended for 18 months to allow Parliament to amend the relevant legislation in accordance with the Court’s decision, failing which the court order would become applicable to affected intestate deceased estates.

The Constitutional Court also ruled recently (in Women’s Legal Trust Centre vs President of the Republic) that Muslim marriages should have the same rights of recognition as legal marriages, which means that the spouses can claim under intestate laws. It is not clear why the same should not apply to all religious marriages.

Requirements for a valid will

Dying without a will leaves a lot of uncertainty for your loved ones as to who gets what, and people you never intended to inherit from your estate end up getting a slice while those who you would want to inherit get nothing. That is why a valid will should be concluded, and the actual requirements are fairly straightforward:

The testator must be a person over the age of 16 years at the time of concluding the will.

The will must be in writing (handwritten or typed out).

It must be signed by the testator and two witnesses (14 years or older) who must all be present at the same time and witness each other signing the document. Each page must be initialled by the testator and witnesses and signed on the last page by the testator and the witnesses.

There should be no large open spaces between the last paragraph and the signatures. This is to prevent fraudulent insertions in the will after signing.

Beneficiaries (and their spouses) under the will must not be witnesses to the will nor be involved in the drafting of the will.

A nominated executor can be a beneficiary under the will but must not be a witness nor be involved in the drafting of the will.

A will can be revoked by the testator at any time and replaced by a new will or the testator may amend an existing will by entering into an amendment document (which is then known as a codicil) as long as the formalities are followed as described above.

If a will does not comply with the above requirements, it can be set aside by a court, and the estate will be regarded as intestate (unless there may have been previous valid wills concluded).

There is no requirement that a will has to be officiated over or drawn up by a lawyer but it is always advisable to seek professional advice.

Wills are governed by the Wills Act of 1953.

Other considerations

Even though the formalities of concluding a valid will are quite straightforward, it is important to take into account various other factors:

If you have minor children, consider who will be their legal guardians in the event you are the only parent or in the event both parents pass away. Also consider who will be the children's custodian. A custodian and legal guardian can be the same person or persons but they are different legal concepts. A legal guardian makes legal decisions on behalf of the child until they become an adult; a custodian is responsible for the day-to-day care of the child.

If you have children also consider providing in the will for the setting up a trust until they reach adulthood when they can then take their inheritance.

Consider the 'what if' scenarios. What if one of your nominated heirs doesn't survive you or is unable or unwilling to take their inheritance? Who will then inherit the nominated heir's share? Will it be their children or their spouse, or will it be inherited by the remaining surviving heirs? What if all your nominated heirs die before you or even at the same time? Who will inherit your estate then?

You can bequeath specific assets to a particular person who is then known as a legatee. You should give very specific details of the assets, eg your 1956 Aston Martin or a specified sum of money, and name the specific beneficiary. Typical examples of bequests are jewellery, memorabilia, heirlooms, the family home or things of sentimental value.

Your heirs are the persons who inherit the residue of your estate and you can choose what proportion each one inherits.

A beneficiary under your will can be both an heir and legatee.

Provide identity numbers of your beneficiaries (legatees and heirs) as far as possible to create certainty.

Name your nominated executor(s) and alternative executor and provide their identity numbers where possible. There is a tendency to nominate an executor who someone knows to be ‘level-headed’ but this does not translate into someone who knows all the onerous duties involved in managing and winding up a deceased estate. An executor is entitled to a fee for their services, which currently is up to 3.5% of the gross value of the estate plus VAT. An executor is also entitled to appoint professional advisors to assist them, and such costs will be borne by the estate. Consideration should be given to rather selecting professional executors and agreeing the fees upfront.

Not all lawyers and accountants know estate law – it is a specialised field.

If no executor is nominated in the will or if a nominated executor is unwilling to take the role, the Master of the High Court will appoint an executor.

Unless the will names an executor and expressly waives the need for that executor to provide security, the Master will require security (a sum of money or a bond from the bank) that acts as a guarantee that the executor will exercise their duties in accordance with the law.

The Master will issue letters of executorship for estates valued at over R250 000 and issues letter of authority for estates valued at less than R250 000 to the appointed executor who will then have full authority over the estate. A nominated executor is not authorised to represent the estate until the Master authorises this by way of formal appointment; the Master also has discretion whether to apppoint the nominated exeuctor - if the Master does not feel the nominated executor has the correct skills or ability then the Master may appoint a more appropriate and qualified executor.

Once your will is validly concluded make sure it is kept in a safe place and that a trusted loved one or your nominated executor knows where to find it.

A family member or another responsible person must notify the Master of the High Court where you ordinarily resided prior to your death of your passing within two weeks.

There are many documents that need to be completed when informing the Master of your passing and you can find the latest version of the documents at the Department of Justice and Constitutional Development site located here: deceased estates.

On your passing, certain documents will be needed and certified copies made. These include:

Deceased person's identity document or passport

Death certificate

Marriage certificate, if applicable

The will

Divorce decree, if applicable

The nominated executor’s ID (if nominated and the role is accepted by the executor)

Once a person passes, their estate becomes frozen, and the assets cannot be distributed or sold or donated to any person without the consent of the executor.

Even though South African law recognises the right of a testator to determine the fate of their estate in accordance with their own wishes, there are circumstances when the court may intervene. For example, where a spouse provides nothing for their partner in the will (either deliberately or by neglecting to update a previous will) then the surviving spouse can apply to the court under the Maintenance of Surviving Spouses Act of 1990. A child who has not been provided for in a will can similarly claim maintenance from the deceased estate provided they can prove that they are in need of such support, and the testator failed to make provision for them in the will or failed to make adequate provision.

Although a testator has testamentary freedom, a court may overrule the wishes of the testator if any provision in the will is against public policy (contra bonos mores). For example a requirement by the testator that an heir can only inherit if he stops being gay, or divorces his wife, or marries someone of the testator’s choosing, or someone within a particular race group.

The type of matrimonial regime will also impact the consequences on a deceased estate:

A couple married in community of property will on dissolution of the marriage due to the death of the one spouse result in the surviving spouse having a claim to half the estate while the deceased spouse's half will be determined according to the will of the deceased spouse (assuming there was a will) or under the principles of intestate law.

A couple married out of community of property with no accrual will have completely separate estates, and the surviving spouse will have not have a claim on the deceased estate unless the will of the deceased made provision for the surviving spouse, or if not, then the surviving spouse can lodge a claim under the Maintenance of Surviving Spouses Act.

A couple married out of community of property with accrual would result in the spouse whose estate has grown less having a claim for half the growth in the other spouse's estate.

The tax man will claim estate duty tax (under the Estate Duty Tax Act of 1955) at a rate of 20% of the net value of the estate up to R30m, and 25% on estates over R30m with an abatement of R3.5m and various allowances being taken into consideration.

Capital gains tax needs to be considered.

If you have life insurance and/or retirement policies, you should ensure that your nominated beneficiaries are kept up to date so that on your passing the insurance company or retirement fund trustees can act in accordance with your wishes. It should be noted that in the case of retirement funds (pension, provident and retirement annuities), the trustees are required under the Pension Funds Act of 1956 to determine if there are any other financial dependents apart from the named beneficiaries, and to make an appropriate apportionment of the funds to the financial dependents and the nominated beneficiaries. Retirement funds do not form part of an estate as it is governed by the Pension Funds Act so the executor will not have any authority over such funds unless the trustees of the funds determine that the deceased estate is the only beneficiary or the testator nominated the estate as the beneficiary (this may be suitable if the testator has no dependents at all but if he does then it is best to nominate the beneficiaries as the processing of retirement funds is limited to one year while the winding up of a deceased estate can take substantially longer).

Review your will regularly, especially with major life changes such as getting divorced, remarried, having children, etc so that certainty is created.

Speaking of divorces, if you happen to die within three months of getting a divorce, section 2B of the Wills Act creates an assumption that your now divorced spouse predeceased you (in other words the ex-spouse would not inherit under your will, assuming you nominated that person as a beneficiary) but such assumption is only effective for a period of three months after your divorce. During this three-month period, if you fail to update your will erasing your ex-spouse as a beneficiary then the assumption falls away, and it will be deemed that you intended your ex-spouse to inherit under your will. So if you and your ex-spouse have an acrimonious relationship best you update your will within the three-month grace period given to you under the Wills Act.

Winding up a deceased estate is a long and arduous process, and it can take years before the heirs get their inheritance, especially if there are creditors and/or the estate is complex.

Although these other considerations seem daunting it should not detract from the fact that a will can be quite simply done provided the formalities are followed. However, if you have a complicated estate and need to provide for other family members, like children, then consider consulting a professional estate planning expert or your financial advisor to help you draft an appropriate will.

Happy living!

Do you have questions about wills or estate planning? Leave them in the comments below!

Share this post to spread awareness.

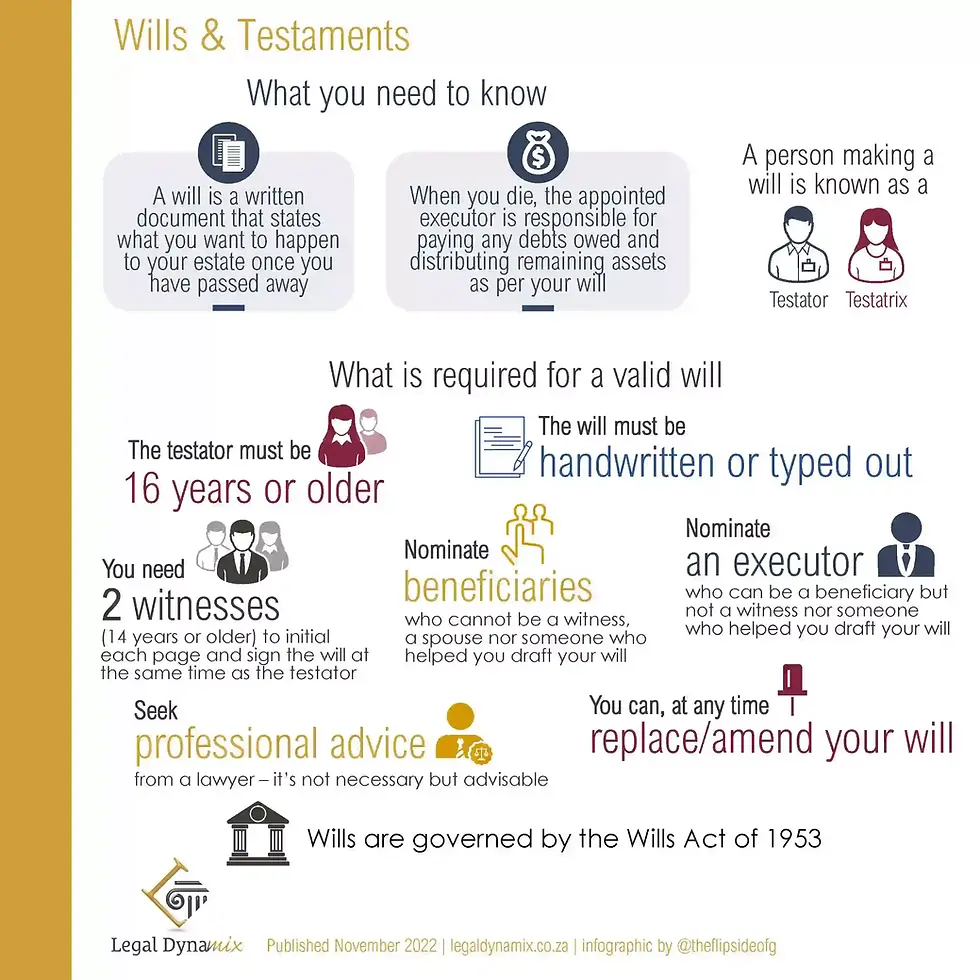

To view a short-form infographic on Wills and Testaments that acts as a quick reference guide, click on the image below.

The information provided is for information purposes and does not constitute legal advice. Contact a lawyer should you require assistance. Legal Dynamix is not a law firm and does not provide legal advice on the subject matter contained herein.

Commentaires